Day 59 - End of Week 12

Foolish Trader Journal, Day 59. End of Week 12.

Market Recap

The market moved up today. There's still some volatility out there, but I think we may have seen the bottom over the past few weeks. My guess is that any future downward moves probably won't go below that recent floor.

- SPY: +1.79%

- QQQ: +1.81%

Trading Update

- Rolled SOFI $9 9/19 Put to a $10 Put with the same expiration, collecting an additional $43 in premium.

- SOFI $10.5 Puts should expire worthless today, allowing me to keep the full premium I collected yesterday.

Portfolio Status

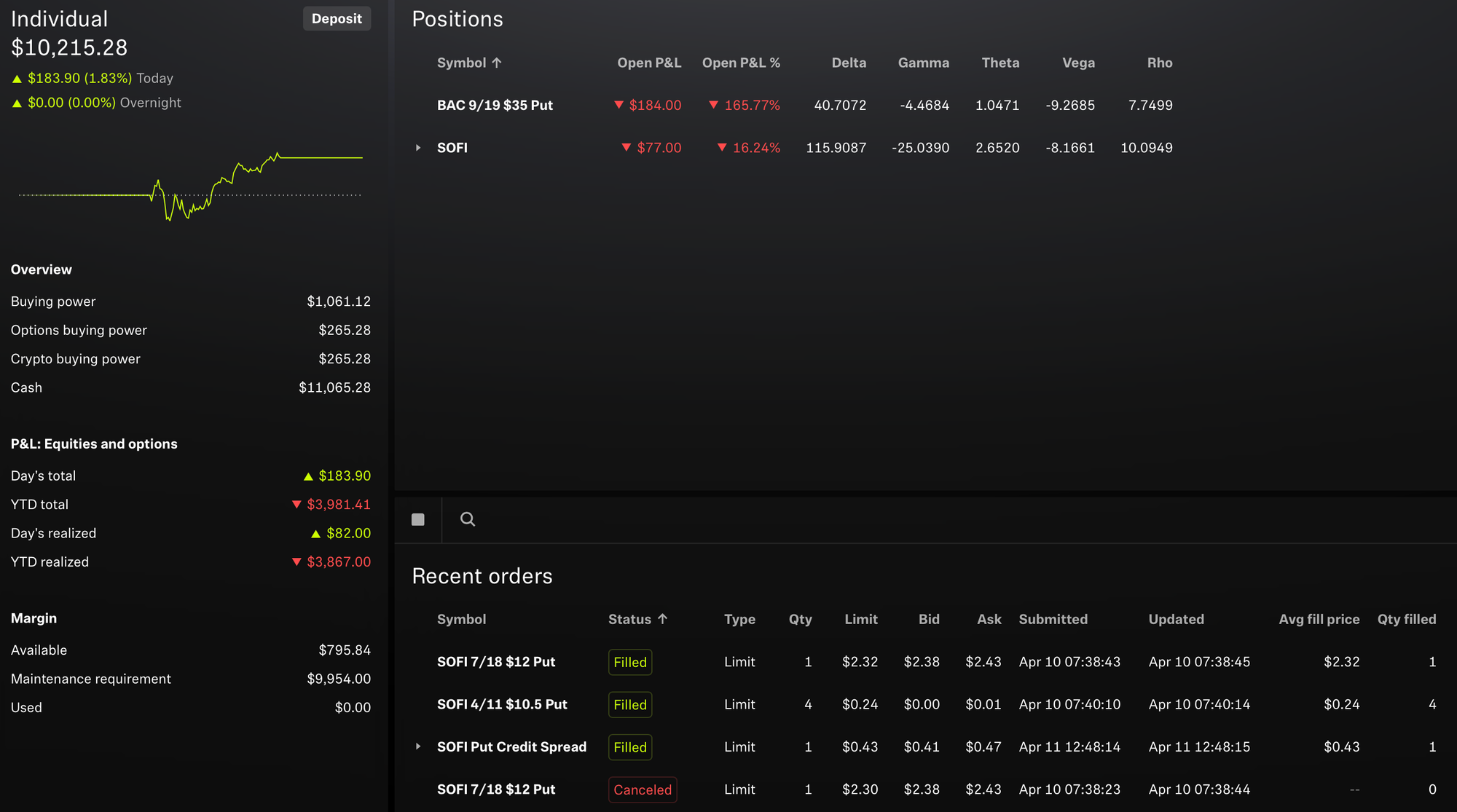

The portfolio is up today, in line with the broader market.

- Today's Change: +1.87%

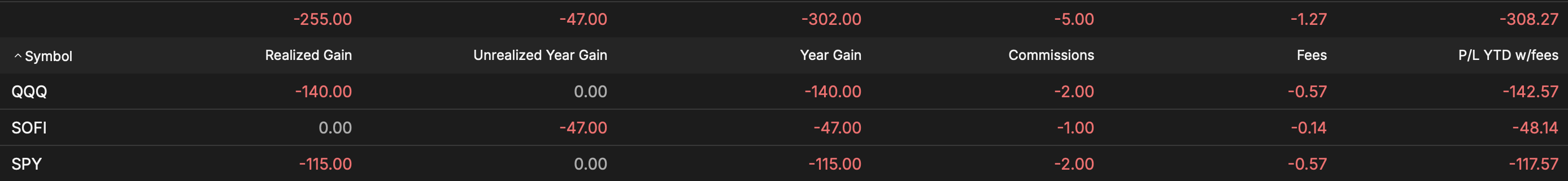

- Year-to-Date (YTD): -28.04%

- SPY (YTD): -9.39%

- All-Time: -37.31%

Here are the open positions.

Trade History

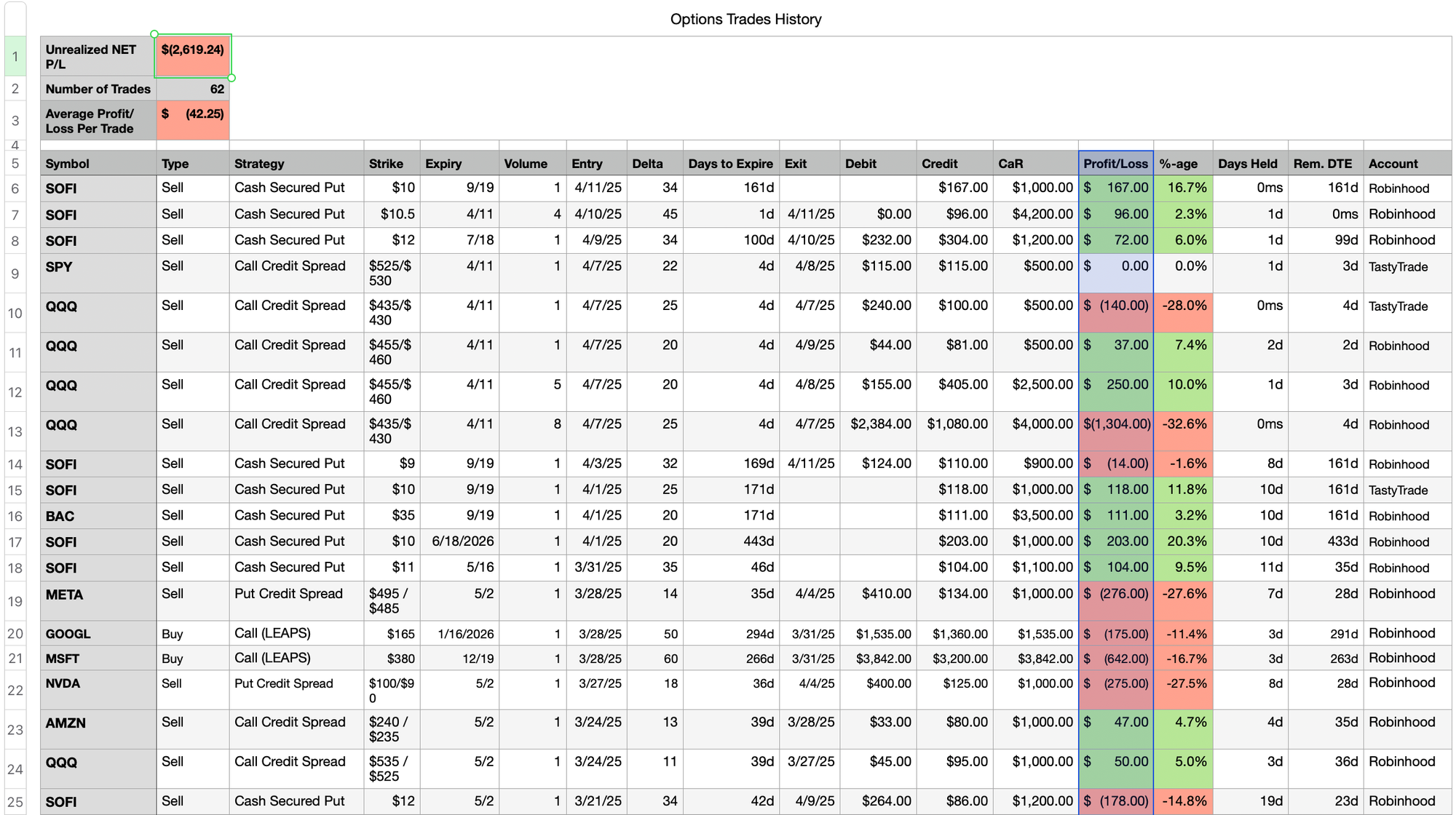

Here are my last 20 trades:

Plan for Next Week

I’m planning to change the frequency of these updates. The daily journals are getting harder to put out every night, so I’m going to experiment with a lighter cadence - maybe 2 or 3 entries per week instead of one every trading day.

Now, back to business. Today marks the end of Week 12 - or one quarter - since I began journaling and tracking trades. The portfolio is down about 26% since then.

One clear takeaway: selling puts around the 30-delta has worked well. I’d really like to refine my spreads. My Put Credit Spread strategy has only lost $44 in the past 3 months, so I’m optimistic about dialing it in further.

Next week, I’ll focus more on Cash-Secured Puts (CSPs) and Put Credit Spreads (PCS), probably leaning a bit more on CSPs.

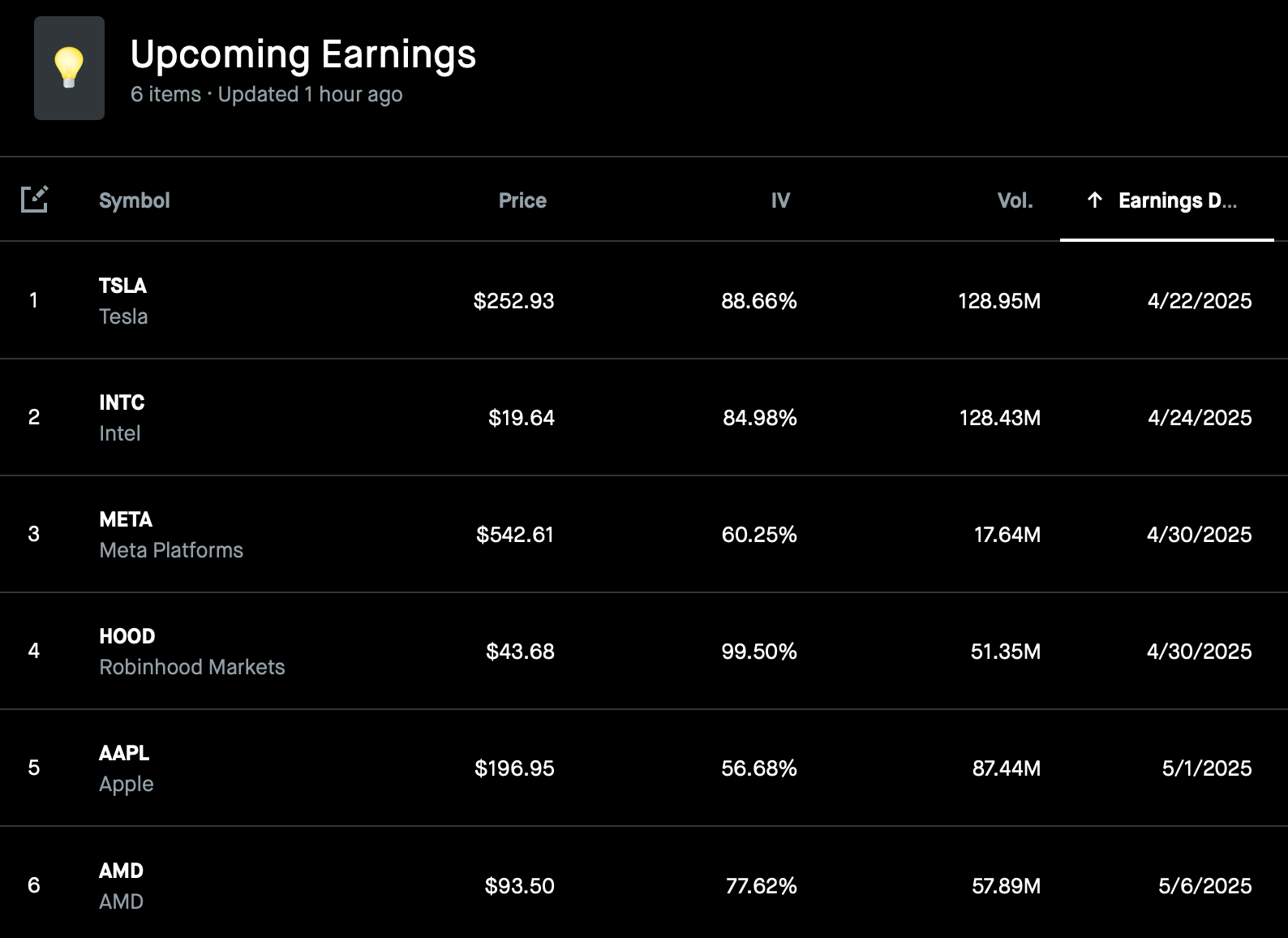

Also, earnings season is right around the corner. I’ve put together a watchlist of stocks I might speculate on, so I’ll be keeping some dry powder ready just in case.

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.