Day 58

Foolish Trader Journal, Day 58.

Market Recap

And we swing down again. Like I said yesterday, the market is meme-y.

The whole market feels like a meme stock

- SPY: -4.36%

- QQQ: -4.25%

Trading Update

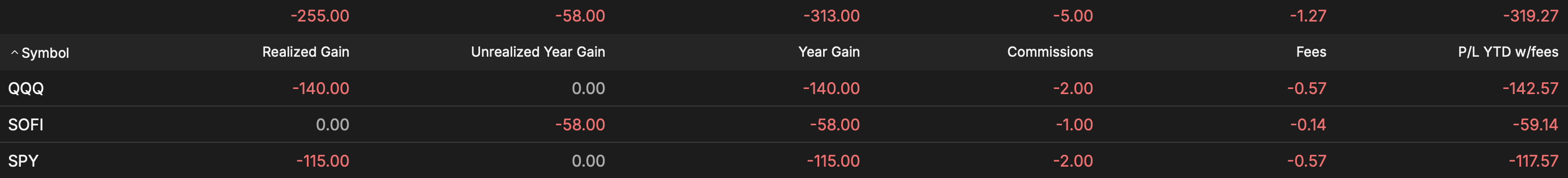

- Closed SOFI $12 7/18 Put

- Net Gain - $72 or 6% in 1 Day

- Sold 4 At The Money Puts for SOFI $10.5 for tomorrow

- Received $96 (2.3%) in Premium

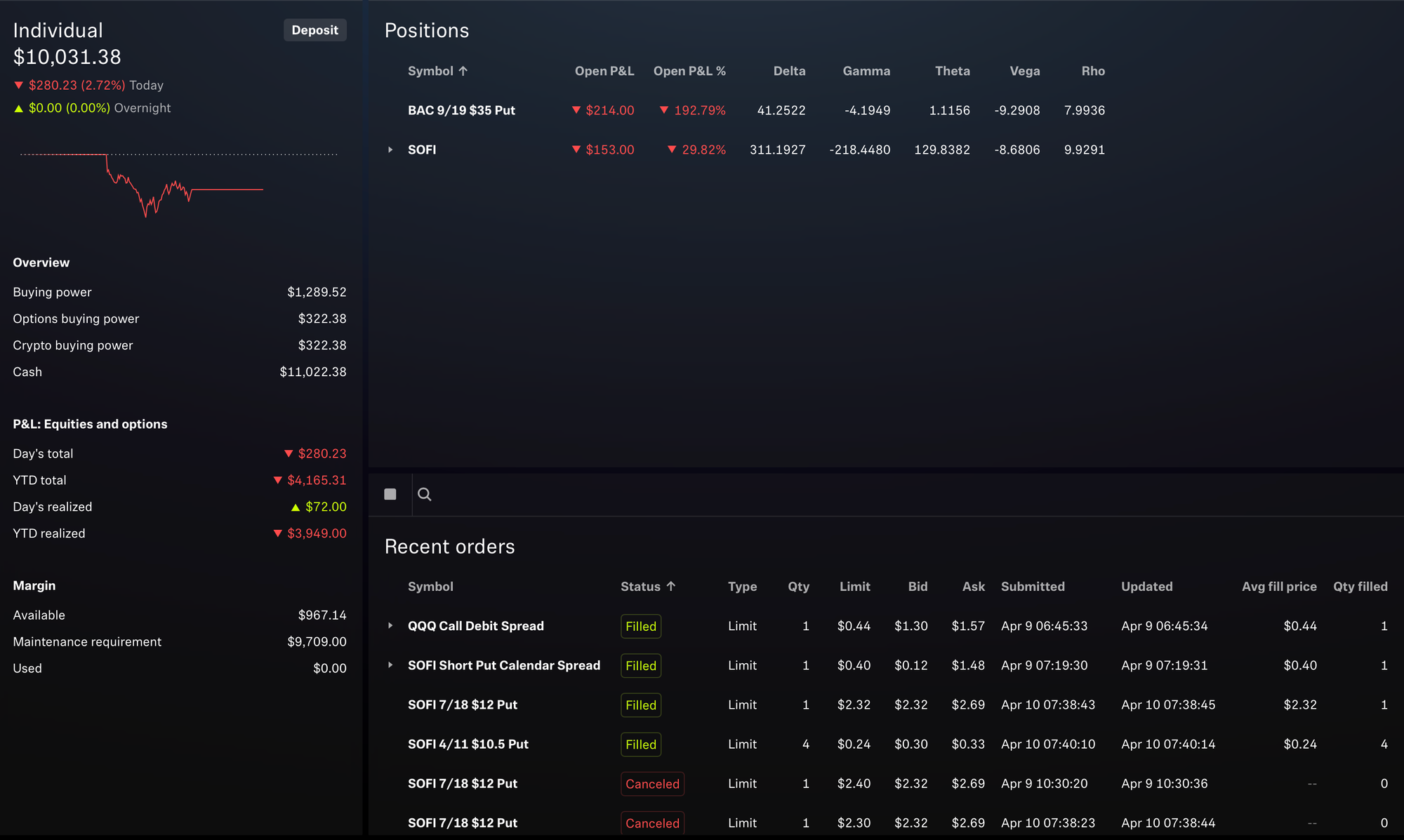

Portfolio Status

Portfolio is down again, like rest of the market.

- Today's Change: -2.72%

- Year-to-Date (YTD): -29.34%

- SPY (YTD): -11.74%

- All-Time: -38.44%

Here are the open positions.

Trade History

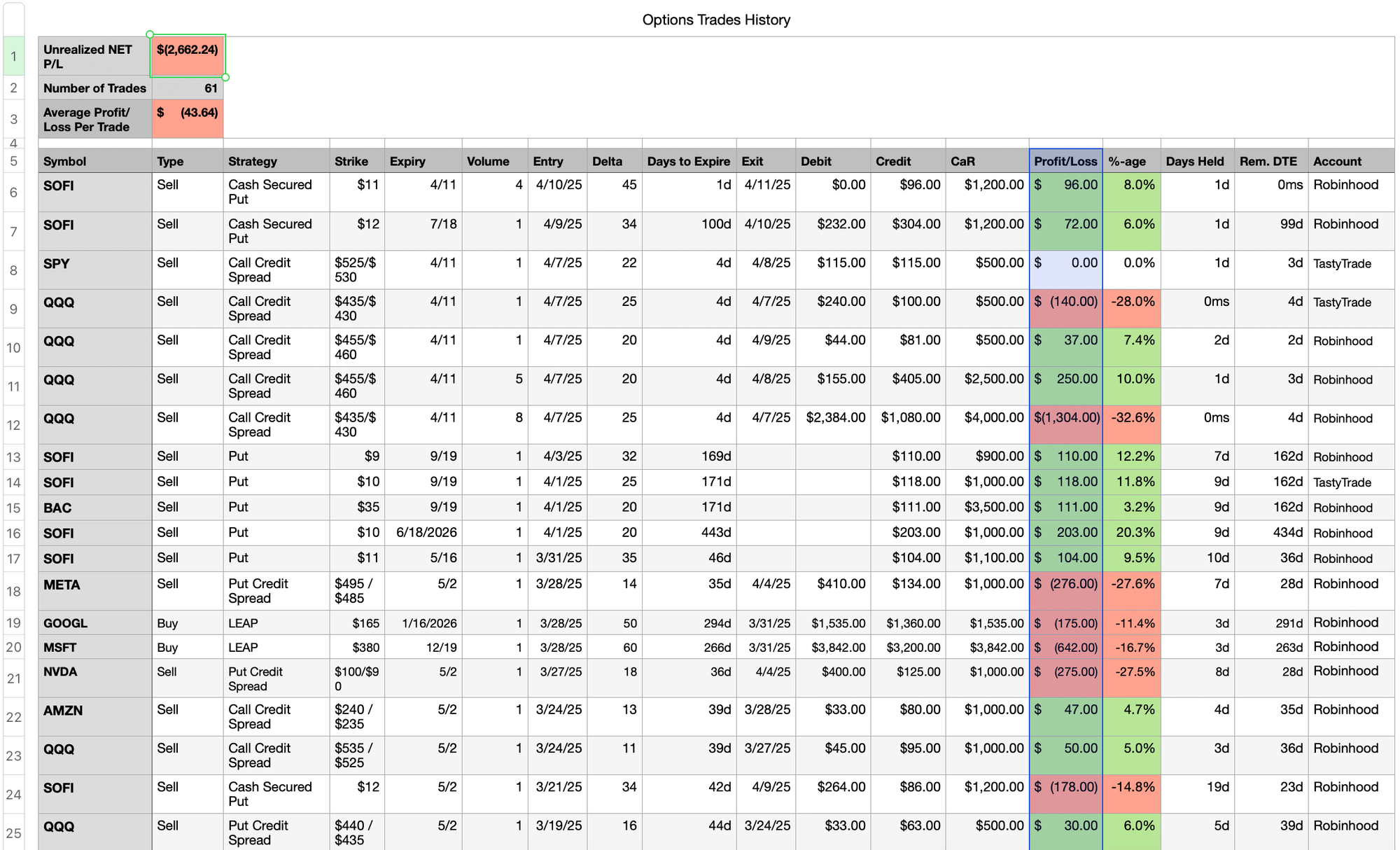

Here are my last 20 trades:

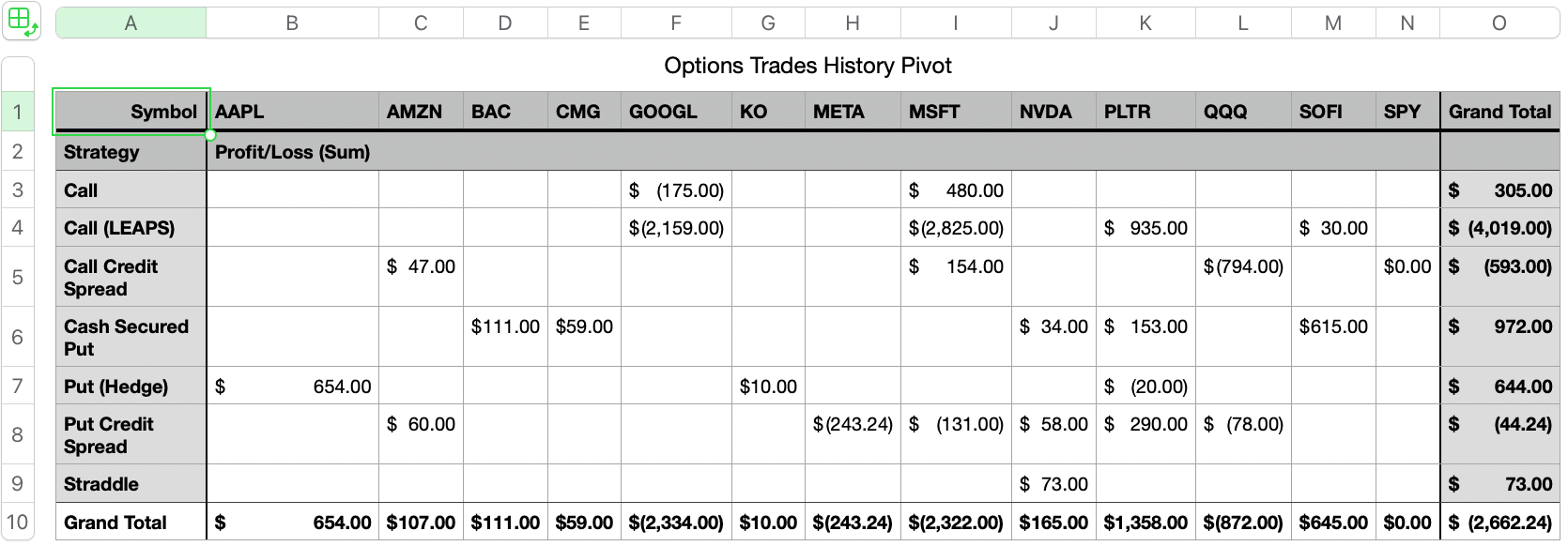

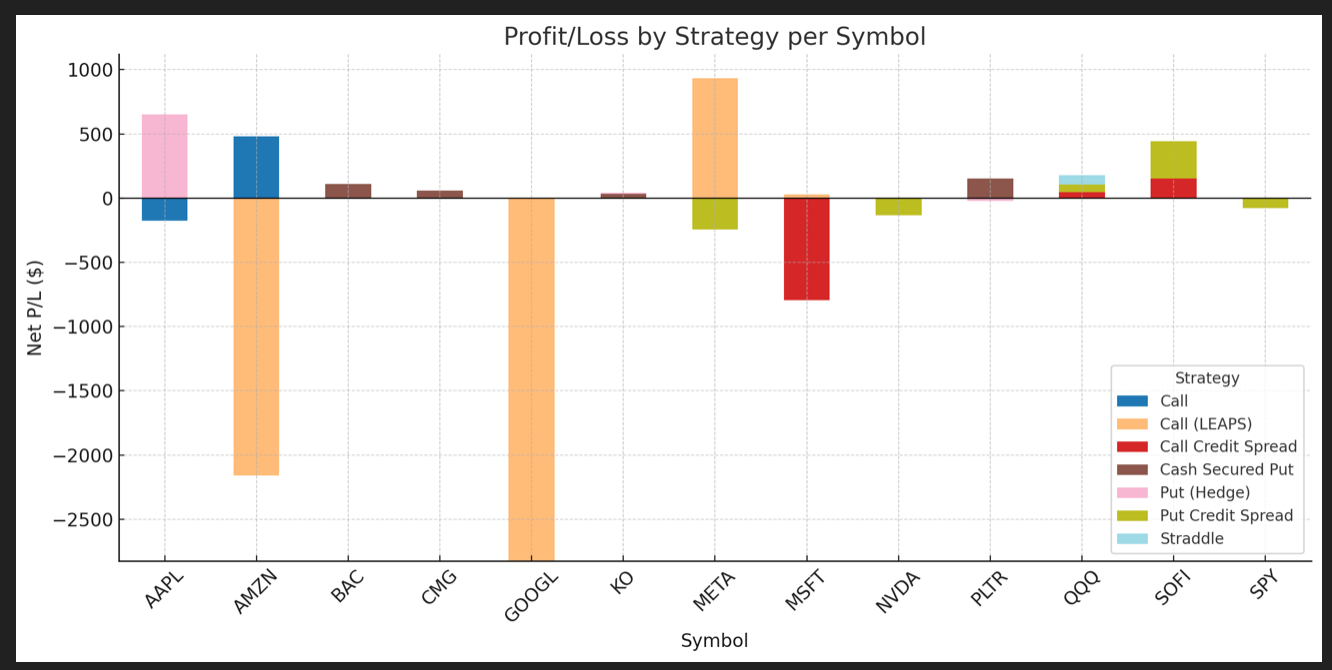

I did a breakdown of all of my trades (not just the last 20) in a simple Pivot Table.

Here are some observations.

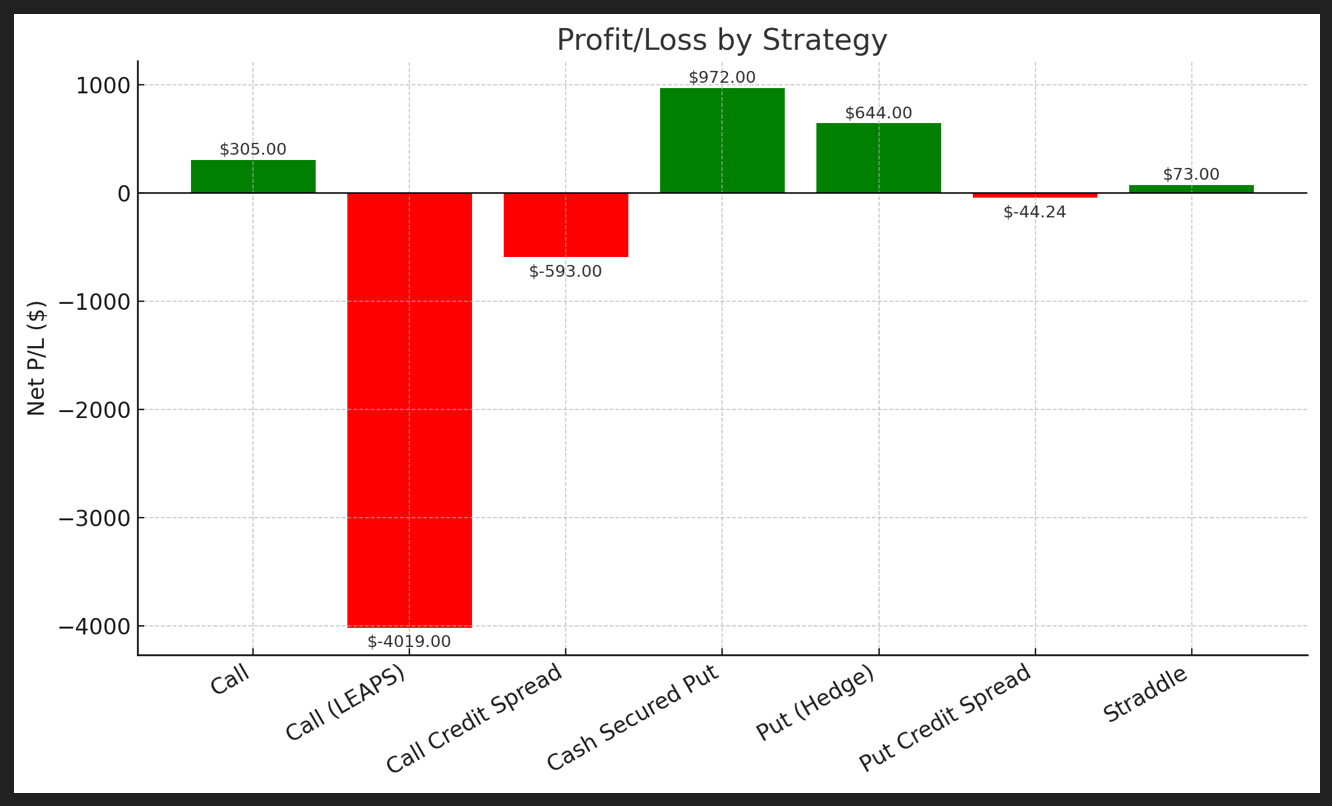

📊 Strategy Analysis

✅ Winning Strategies:

- Cash Secured Puts: +$972

My MVP. This strategy is clearly working well across multiple tickers (BAC, PLTR, SOFI).- Might be worth doubling down here.

- Need to standardize entry conditions to scale.

- Call (non-LEAPS): +$305

I had one profit and one loss. This one needs more data points to give any useful information. - Straddles: +$73

Just one trade? And it worked. This was during the last NVDA earnings. Maybe I should try a few more selectively (especially in volatile earnings weeks).

❌ Losing Strategies:

- Call (LEAPS): –$4,019

This is the biggest drag. I have retired this strategy for now. - Put Credit Spreads: –$44.24

Not a massive loss, but very mixed results. In fact, half of my trades were winners and half were not. Just that the non-winners were slightly larger. I think it may be worth reviewing entry deltas, width, and stop-loss rules and perhaps trading this more mechanically in my TastyTrade account. - Call Credit Spreads: –$593

This also did not have enough data to go off. The one large loss was on the day where one false news sent stocks soaring high, and I had to manage my trade at a loss. - Put Hedge: +$644

Technically a hedge, but surprisingly profitable. I was directional on maybe one or two, so I cannot say I predicted correctly. Maybe I am better at bearish trades than I thought.

Plan for Tomorrow

If the market goes down further, I am hoping to get assigned on my $10.5 SOFI Put that is expiring tomorrow and begin Selling Covered Calls on them.

If the market goes up, I am hoping it goes up enough so the other Puts I have sold are in the money, and then I will look to capture profits on some of them.

If there is not enough movement at all, then I will just sit on the sidelines.

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.