Day 57

Foolish Trader Journal, Day 57. We are meme-y!

Market Recap

Well, that escalated quickly.

- SPY: +9.45%

- QQQ: +11.80%

Trading Update

Closed out my remaining QQQ bear call spread just before the rocket launched. Also rolled my SOFI put right before things got silly again.

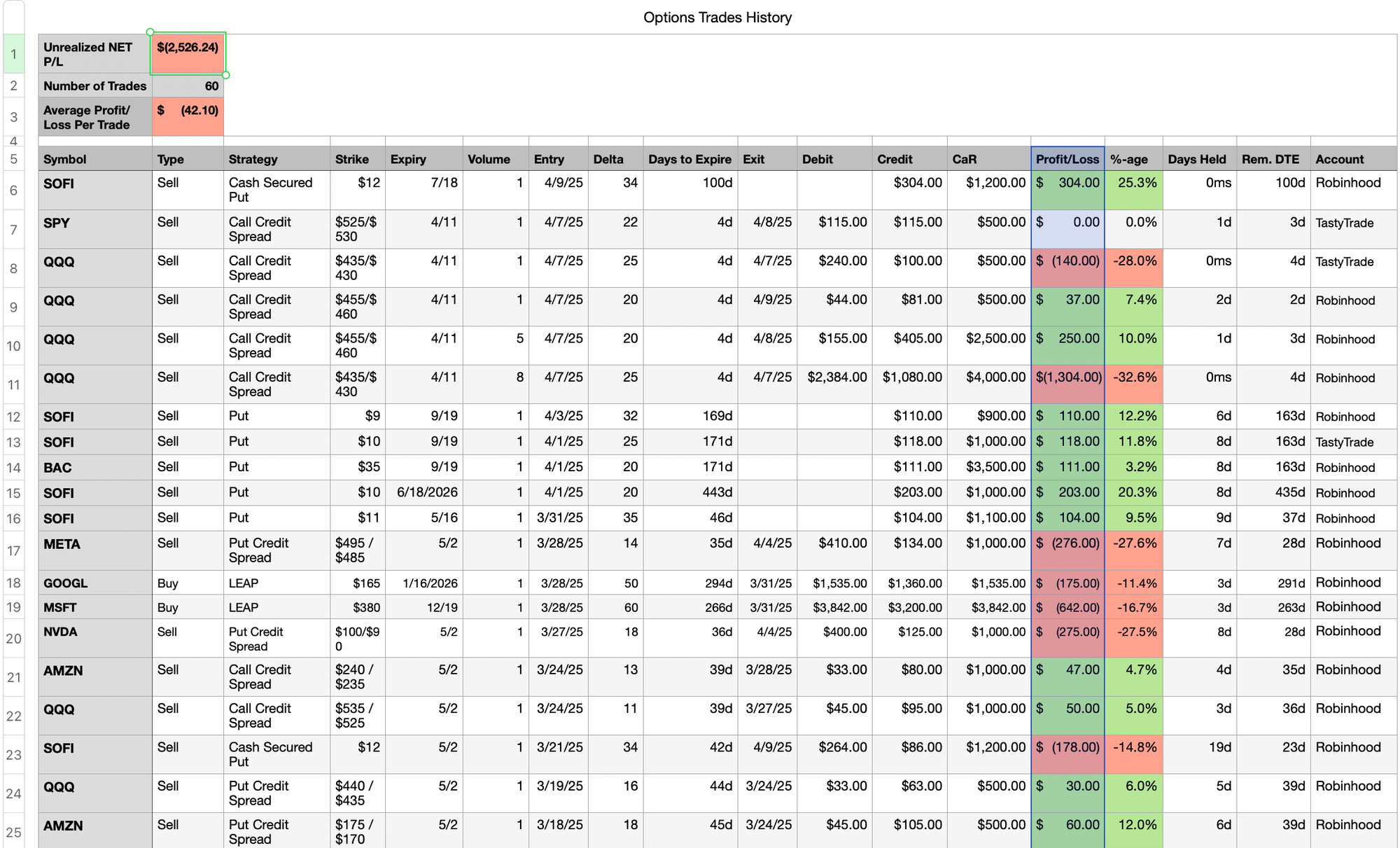

- Closed: QQQ $455/$460 Call Credit Spread for a net premium of $37 — that’s a 7.4% return in just 2 days. Short and sweet.

- Rolled: SOFI 5/2 $12 Put → 7/18 $12 Put for an extra $40 in premium. Because why not get paid to procrastinate?

Portfolio Status

This is hilarious. I grind for weeks and the needle doesn’t budge. I take my hands off the wheel for one day and boom - we are printing green candles.

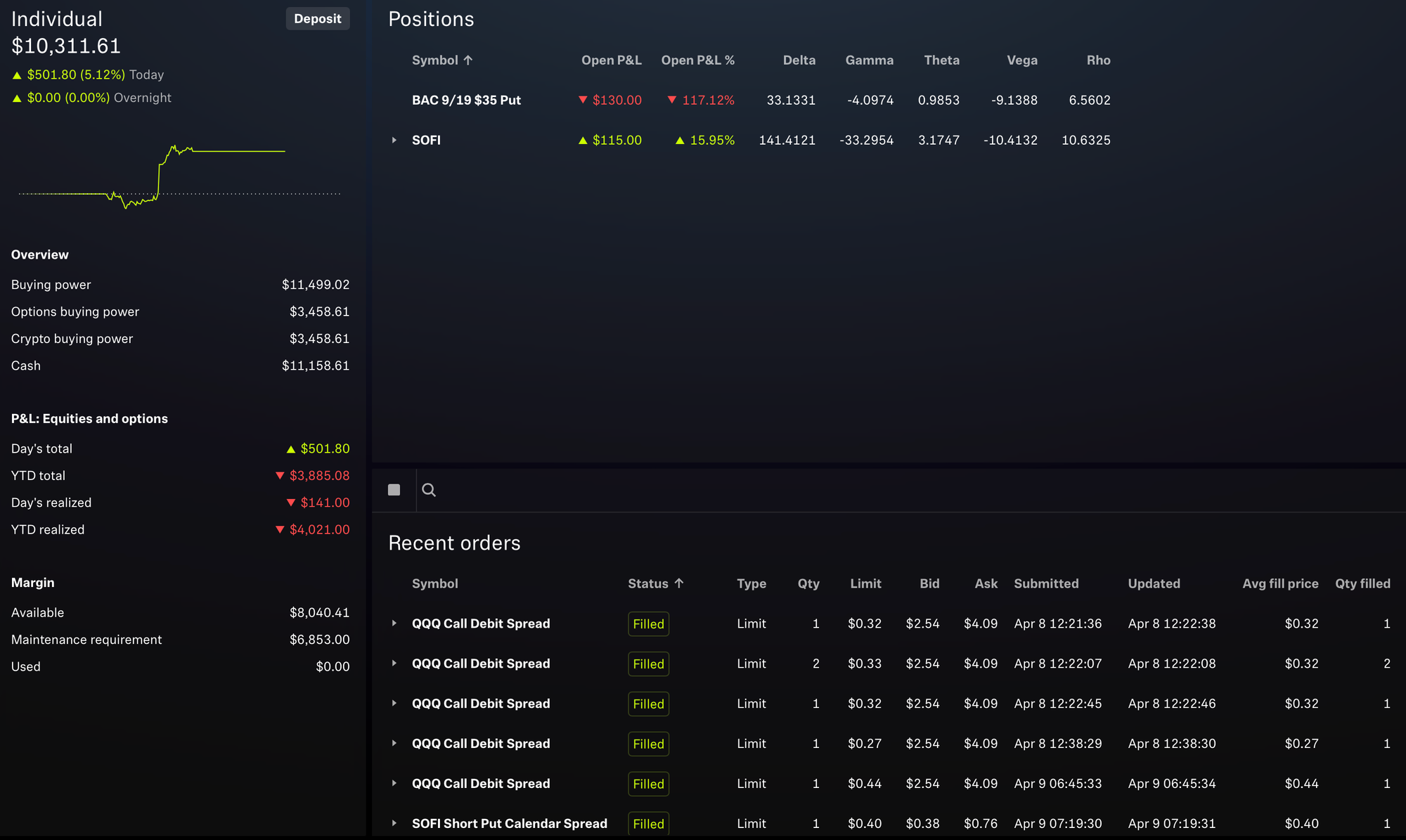

- Today's Change: +5.12%

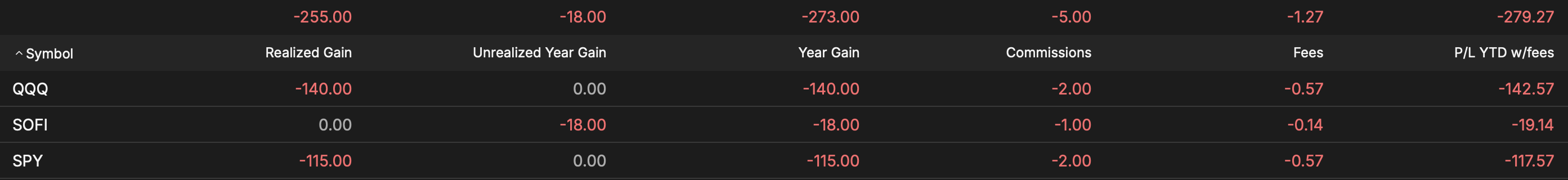

- Year-to-Date (YTD): -27.37%

- SPY (YTD): -8.5%

- All-Time: -36.72%

Here are the open positions.

Trade History

Here are my last 20 trades:

Plan for Tomorrow

Do I have a plan? Not really.

The whole market feels like a meme stock. Fundamentals? Never heard of them.

I’ll probably sell some spreads or puts to collect premium like a responsible adult but I will let the opening bell vibes decide which way I go. Looking for volatility like a heat-seeking missile.

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.