Day 55

Foolish Trader Journal, Day 55. Madness. Another personal crash.

Market Recap

The market moved up today.

- SPY moved up by 1.38%.

- QQQ moved up by 1.72%.

However, there were some wild intra-day swings, and I unfortunately got caught in them.

Trading Update

Last week, I mentioned

One other idea I have is to switch to Selling Call Credit Spreads to carry me through the year - I am down by over 30% and it is going to require some serious luck to turn this around.

With that in mind, I transferred some more funds into both my Robinhood and TastyTrade accounts and promptly sold spreads for the entire new buying power I had acquired.

And almost as soon as the trade was made, the market reversed, and not just reversed, but the indices, both SPY and QQQ moved over a percent in an unfavorable direction of my trade.

I yelled at my foolishness, but no noise came.

I closed the trade, earning 1 day trade mark (both Robinhood and TastyTrade will mark you as a day-trader if you had a certain number of day-trades in a rolling 5 day window).

However, my theory of selling spreads remained untested. So I almost as quickly adjusted my trades further out in cost.

Here are the final trades for today:

- Sold (to open) 8 QQQ $435/$430 4/11 (4 DTE) Call Credit Spreads

- Received $1080 in Premium

- Bought (to close) 8 QQQ $435/$430 4/11 (4 DTE) Call Credit Spreads

- Cost $2384

- Sold (to open) 6 QQQ $455/$460 4/11 (4 DTE) Call Credit Spreads

- Received $486 in Premium

- Sold (to open) 1 QQQ $435/$440 4/11 (4 DTE) Call Credit Spread

- Received $100 in Premium

- Bought (to close) 1 QQQ $435/$440 4/11 (4 DTE) Call Credit Spread

- Cost $240

- Sold (to open) 1 SPY $525/$530 4/11 (4 DTE) Call Credit Spread

- Received $115 in Premium

Portfolio Status

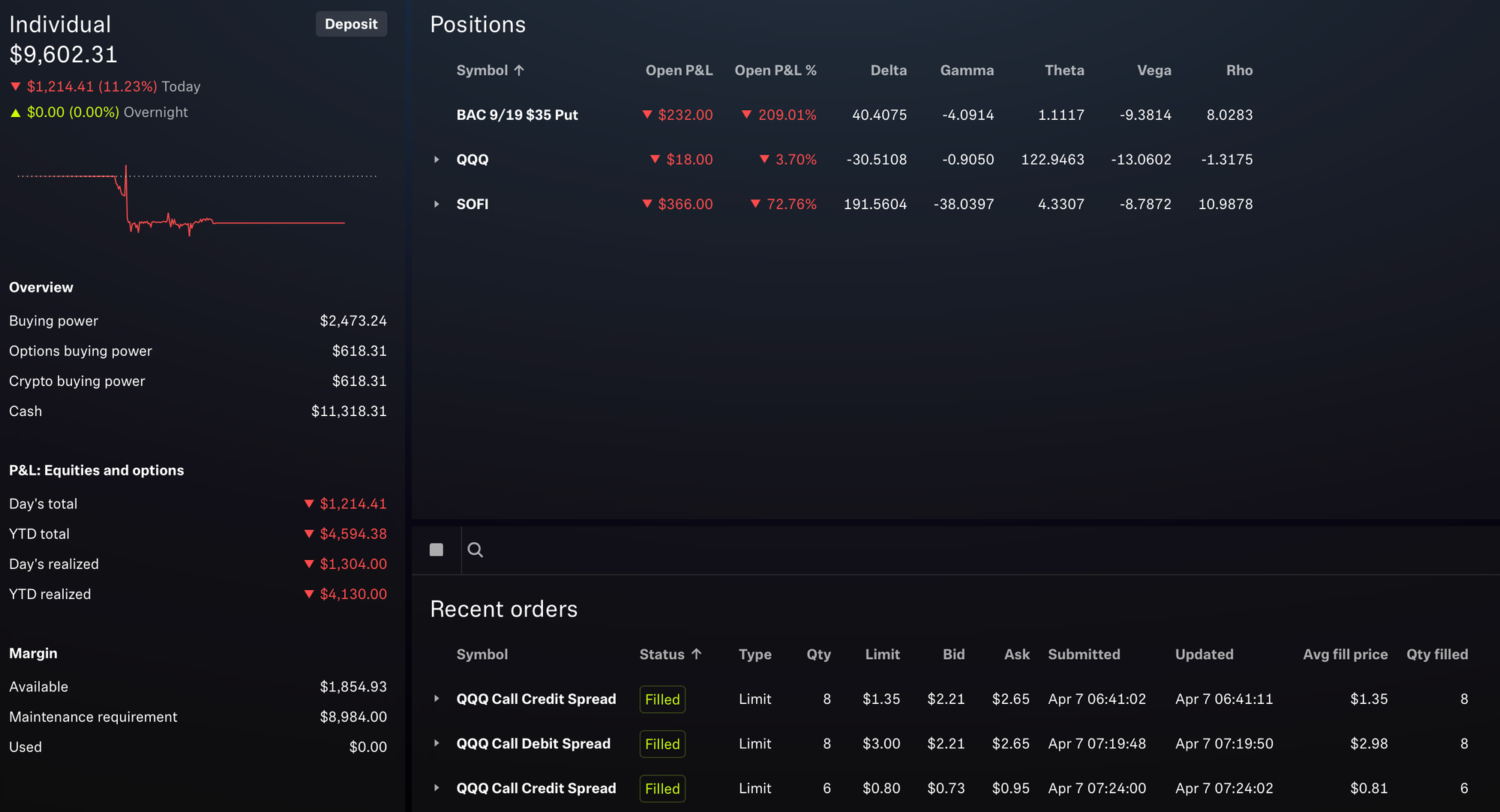

And we continue to fall.

- Today's Change: -11.23%

- Year-to-Date (YTD): -32.36%

- SPY (YTD): -13.43%

- All-Time: -41.07%

Here are the open positions.

Trade History

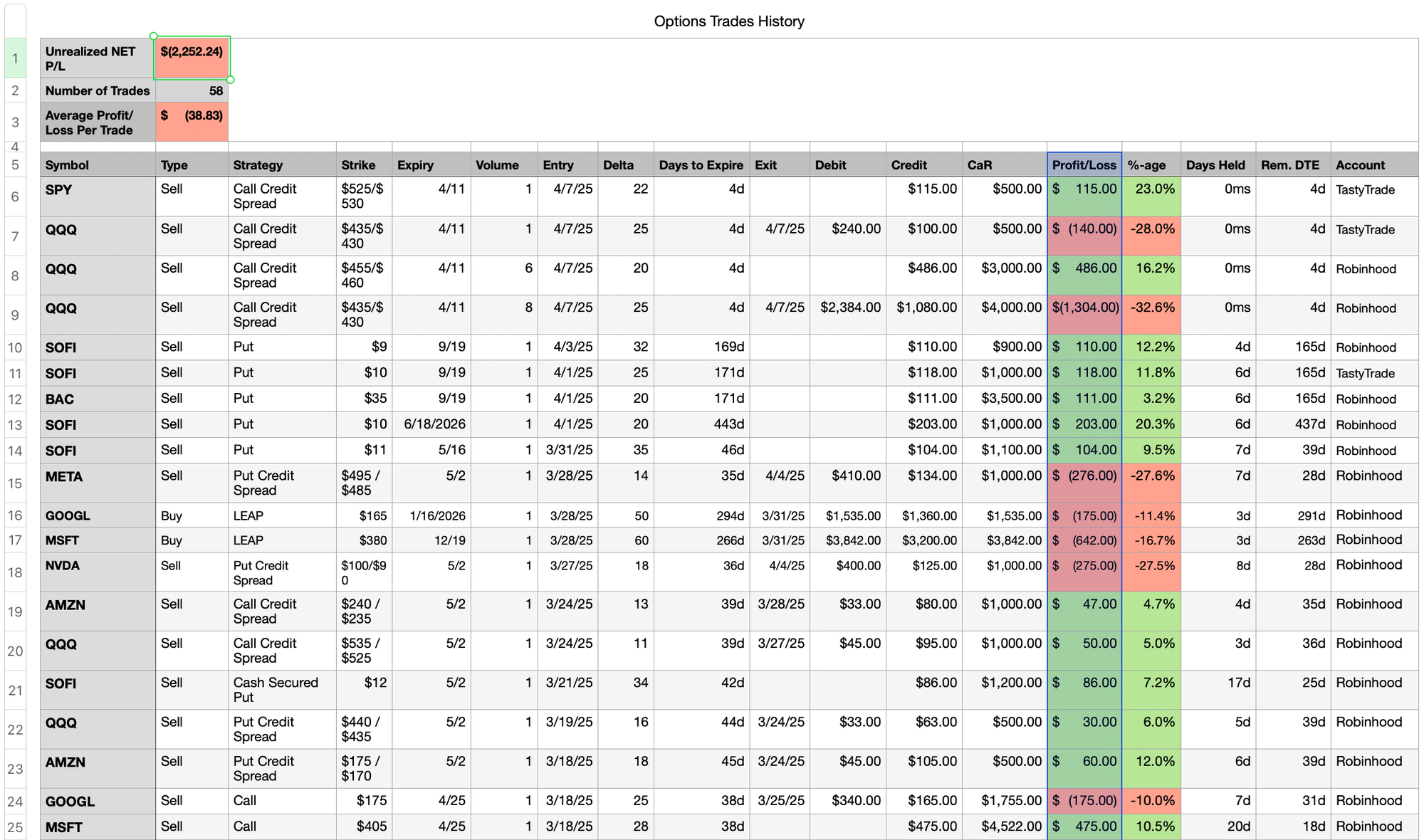

Here are my last 20 trades:

Plan for Tomorrow

I will look to manage existing positions. And avoid opening any more new positions.

📌 Disclaimer: Nothing on this site is financial advice—I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.